Disseminare Consulting has two products :

Digital training is one of the most effective tools of learning for self motivated learners. Disseminare believes in sharing of knowledge at a very affordable price. Price should not be constraint of learning. Disseminare has created one of the best digital learning contents in banking. It is offering its digital training products in the form :

● Self paced learning : Under this mode, customer can learn in own pace through state of the art Learning Management Solution (LMS) platform prepared by Disseminare Consulting. Disseminare Consulting prepared large number of extremely high quality digital learning courses.

● Instructor lead virtual training : Under this mode, Disseminare is providing live online classes in the zoom platform to corporates through customised workshops as well as through open workshops. Disseminare has created unique learning journey for banks and other financial institutions to develop a large number of people in the areas of credit and risk management which is the most critical area of banking.

Disseminare conducts both public workshops and customised workshops.

Under public workshop, it would announce a topic and would send invites to several banks and Non Banking Financial Institutions (NBFIs). Officials from these organisations would participate in the workshop.

Benefits of public workshop :

●Net working

● Market knowledge

● Personal development

● Organisational development

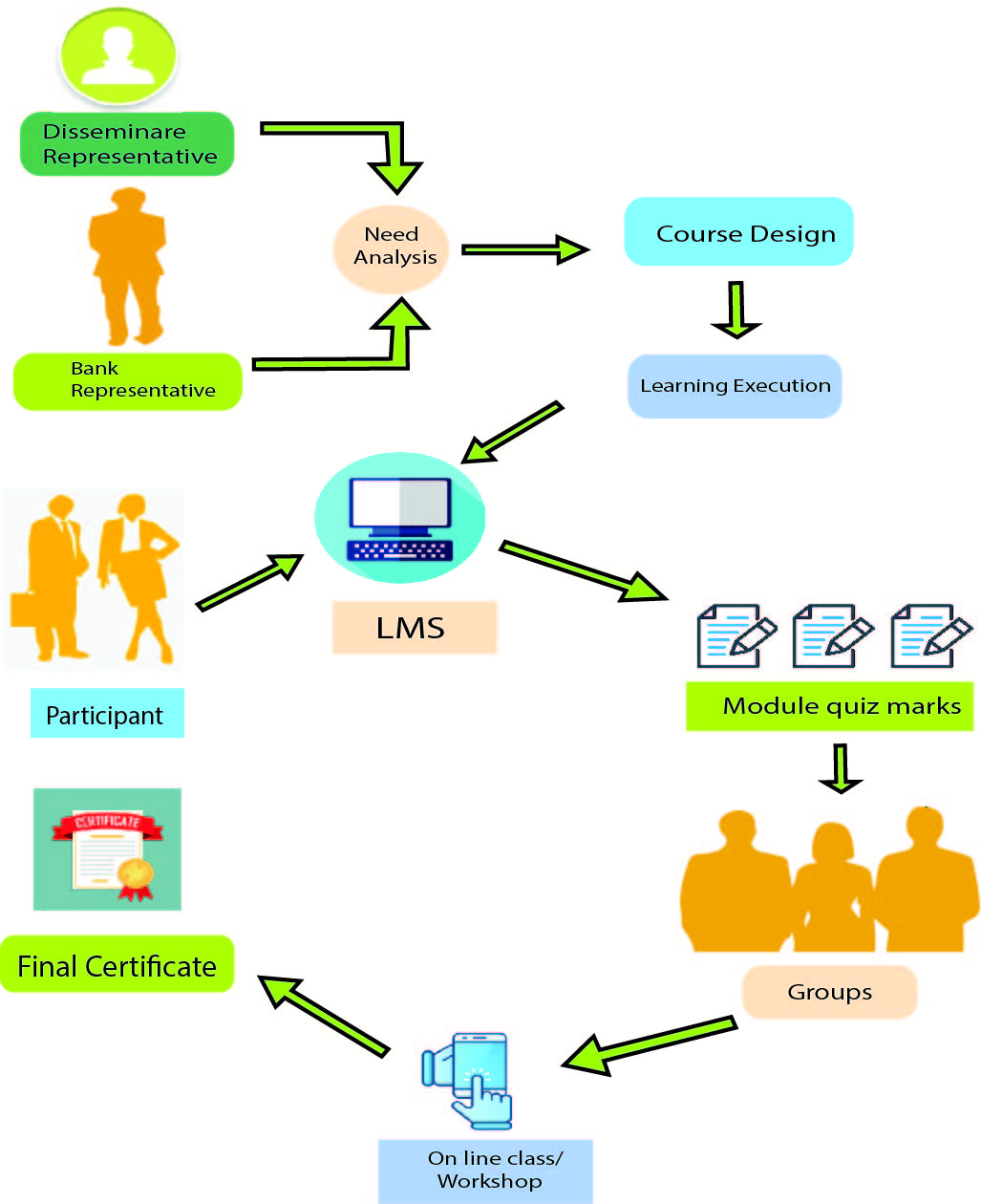

Disseminare also conducts highly customised workshops. Under this , Disseminare finds out the need of the customer and based on need Disseminare conducts workshop which can impart highly focussed skills within shortest possible times. Disseminare adopts the following methods for this type of workshop:

Disseminare believes in the development of ecosystem. Accordingly, Disseminare provides consulting services to both lending institutions as well as Micro Small and Medium Enterprise (MSME).

Consulting to banks :

Disseminare can helps banks to develop highly customised credit scoring models as per requirement of banks. These models can help banks to underwrite loans based on data driven decisions rather than subjective decisions. Disseminare can help lending institutions Machine Learning (ML) based credit scoring models and it would help the banks to underwrite loans based on this models.

Consulting to MSMEs :

Disseminare can helps MSMEs to become efficient. Bangladesh is emerging as economic power house in the coming years and MSMEs can reap extraordinary benefits in this situation. Disseminare can help MSMEs to prepare themselves to reap the benefits of their lifetime.